Medical Blue Advantage of Arkansas Blue Cross Blue Shield Hdhp

Types of health insurance plans

Selecting a health insurance plan is like searching for the right pair of jeans. It can be time consuming and you may have to look at several, but it's worth it to find the right fit.

Let's review the following plans and how they might be the best match for you:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Point-of-Service (POS)

- High-Deductible Health Plans (HDHP)

- The Metal Plans

Health Maintenance Organization (HMO)

With this plan, you choose a primary care provider (PCP) who coordinates your care using doctors and hospitals that are in your plan's network. If you need a specialist, such as a cardiologist (heart doctor), a referral from your PCP is required. Generally, an HMO won't cover services from an out-of-network provider.

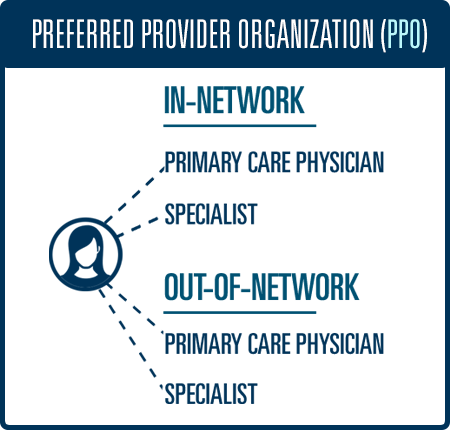

Preferred Provider Organization (PPO)

This plan allows you to manage your own care, with or without referrals from your PCP. You can choose which provider you want, whether they are in or out of network.

Point-of-Service (POS)

The Point-of-Service is like a combination of HMO and PPO. Like an HMO, you choose a doctor, also called a primary care provider (PCP). But like a PPO, you can get medical care from both in- or out-of-network providers. You'll pay less when you use a doctor or hospital in network and more if you choose out of network.

High-Deductible Health Plans (HDHP)

This plan gives you the most control on how your healthcare dollars are spent. A High Deductible Health Plan usually has a high deductible but a low monthly premium and a special spending account to help you save money for healthcare expenses. These special accounts include health savings accounts (HSAs), health reimbursement account (HRAs) and flexible spending accounts (FSAs).

Metal categories

Health plans are broken into categories named after metals: Bronze, Silver and Gold. These categories reflect how you and your plan share the cost of your healthcare. The plan you select has nothing to do with the quality of care you receive — but rather how much you pay for healthcare services. A Bronze plan is ideal for people who don't plan on using their insurance very often and a Gold plan is good for people who use the healthcare system more often.

Bronze

A Bronze plan will cover about 60% of your medical costs.

Silver

A Silver plan will cover about 70% of your medical costs

Gold

A Gold plan will cover about 80% of your medical costs

The more your insurance company pays, the higher your monthly premium will be.

Bronze

- Lowest monthly premium

- Highest costs when you need care

- Bronze plan deductibles — the amount of medical costs you pay before your insurance plan starts to pay — can be thousands of dollars a year

- Good choice if: You want a low-cost way to protect yourself from worst-case medical scenarios, like serious sickness or injury. Your monthly premium will be low, but you'll have to pay for most routine care yourself.

Silver

- Moderate monthly premium

- Moderate costs when you need care

- Silver plan deductibles — the costs you pay before your plan pays anything — are usually lower than those of Bronze plans

- Good choice if: You qualify for "extra savings" — or, if not, if you're willing to pay a slightly higher monthly premium than Bronze to have more of your routine care covered.

Important: If you qualify for "extra savings" (sometimes called "cost-sharing reductions") on your deductible, copay, and coinsurance, it might be best for you to pick a Silver plan. You can save hundreds or even thousands of dollars per year if you use a lot of care.

Gold

- High monthly premium

- Low costs when you need care

- Gold plan deductibles — the amount of medical costs you pay before your plan pays — are usually low

- Good choice if: You're willing to pay more each month to have more costs covered when you get medical treatment. If you use a lot of care, a Gold plan could be a good value.

flanneryforad1979.blogspot.com

Source: https://www.arkansasbluecross.com/looking-for-insurance/individual-family-plans/before-enrollment/types-of-insurance-plans